Insurance Brokers Code of Practice

The Insurance Brokers Code of Practice sets clear standards for professional and ethical conduct that clients can expect from brokers who subscribe to it.

The Insurance Brokers Code of Practice sets clear standards for professional and ethical conduct that clients can expect from brokers who subscribe to it.

Developed by the National Insurance Brokers Association (NIBA), the Code sets out the standards of professionalism, integrity and fairness that clients should expect from brokers who subscribe to it. These standards often go beyond what the law requires, offering extra protections and peace of mind.

The Code is independently monitored and enforced by the Insurance Brokers Code Compliance Committee (IBCCC). This independent oversight helps build trust and confidence among clients, knowing that brokers are held to account for the promises they make.

Brokers who subscribe to the Code commit to:

- Act honestly and with integrity in all dealings with clients, insurers and others

- Promote and uphold the ethical standards of the insurance broking profession

- Putting clients’ interests first when providing advice and services

Handling complaints promptly and fairly

The Code is designed to guide both brokers and clients through the insurance journey, from choosing a policy to managing claims. It explains what good service looks like and what clients can do if something goes wrong.

Before launching the current Code in March 2022, NIBA engaged in extensive consultation with consumer groups, regulators and the broader insurance community. This collaboration helped shape a Code that is practical, relevant and focused on real client needs.

To keep pace with changes in the insurance landscape and client expectations, the Code is reviewed at least every three years, or sooner if needed.

Whether you are a broker looking to demonstrate your commitment to professional practice, or a client wanting to understand your rights and the standards you should expect, the Code is designed to support and protect you.

Resources

Terms of Engagement Template

DownloadCode of Practice Review

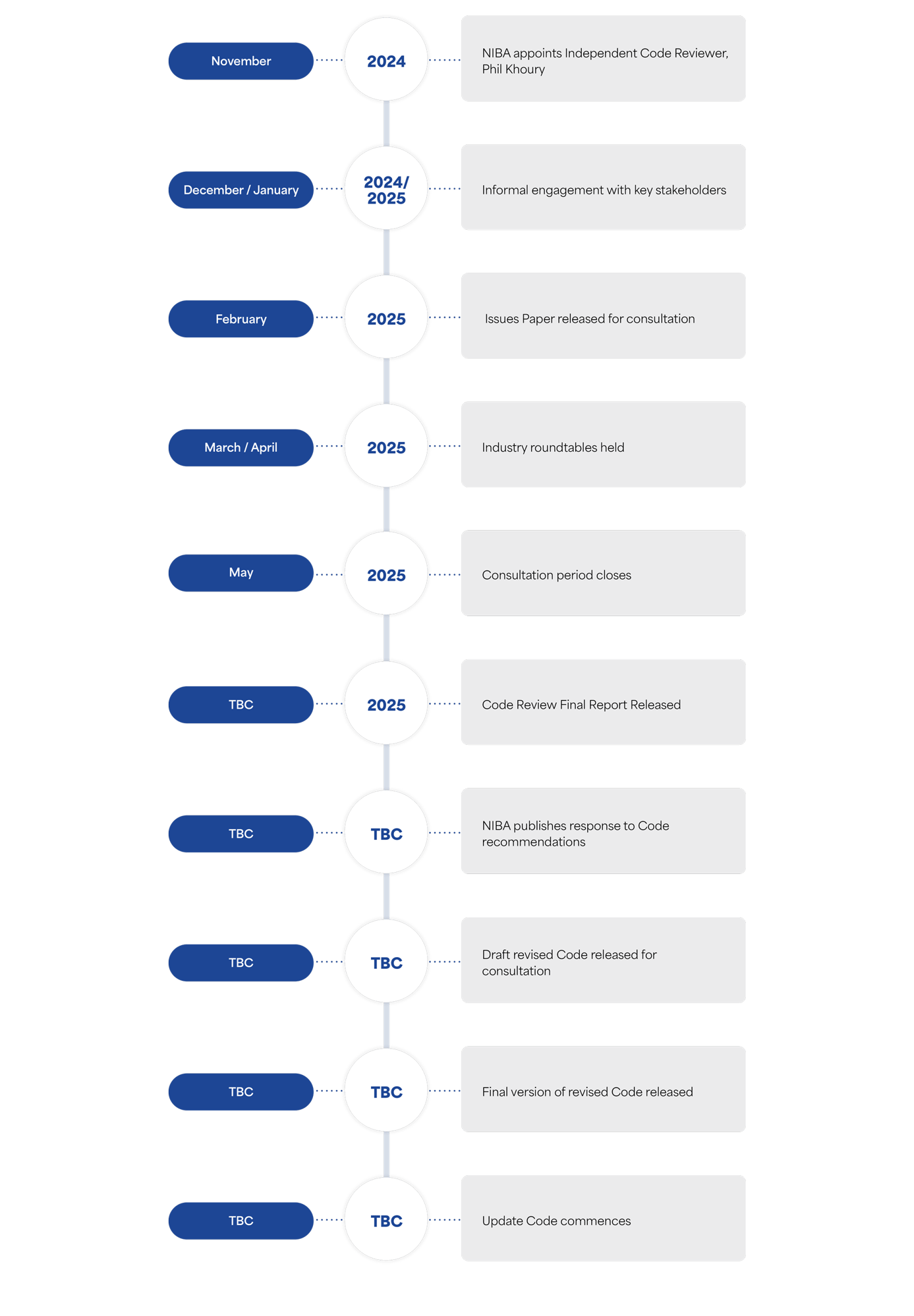

The 2022 Insurance Brokers Code of Practice is currently under review to ensure it remains fit for purpose and continues to support high standards of professionalism, transparency and consumer outcomes across the industry.