Insurance Brokers Code of Practice Review

Your Voice, Your Code

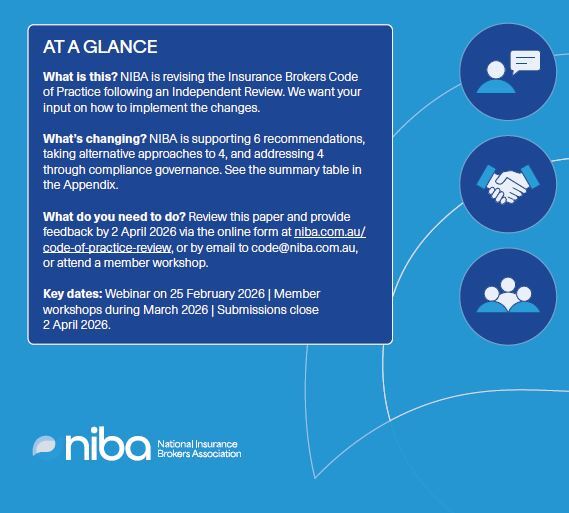

The Insurance Brokers Code of Practice sets out the standards and values that guide insurance brokers across Australia in serving their clients. It plays a central role in promoting trust professionalism and ethical conduct within the broking profession.

It is your Code. For it to work, it must reflect both the needs of the consumers you serve and the practical realities of

professional broking practice.

The review, led by independent Reviewer Phil Khoury from Cameron Ralph Khoury ('crk') examines whether the Code:

- remains fit for purpose in a changing regulatory and commercial environment

- meets rising expectations of clients, government, regulators, and other stakeholders

- continues to strengthen trust and confidence in the role brokers play for their clients

This is your opportunity to help shape the revised Code. We want to hear what works, what doesn’t, and how the Code can be strengthened while remaining workable.

Consultation closes Thursday, 2 April 5.00 PM AEDT.

Members can get involved or provide feedback in two ways:

Nick Cook

NIBA President

Code Review Resources

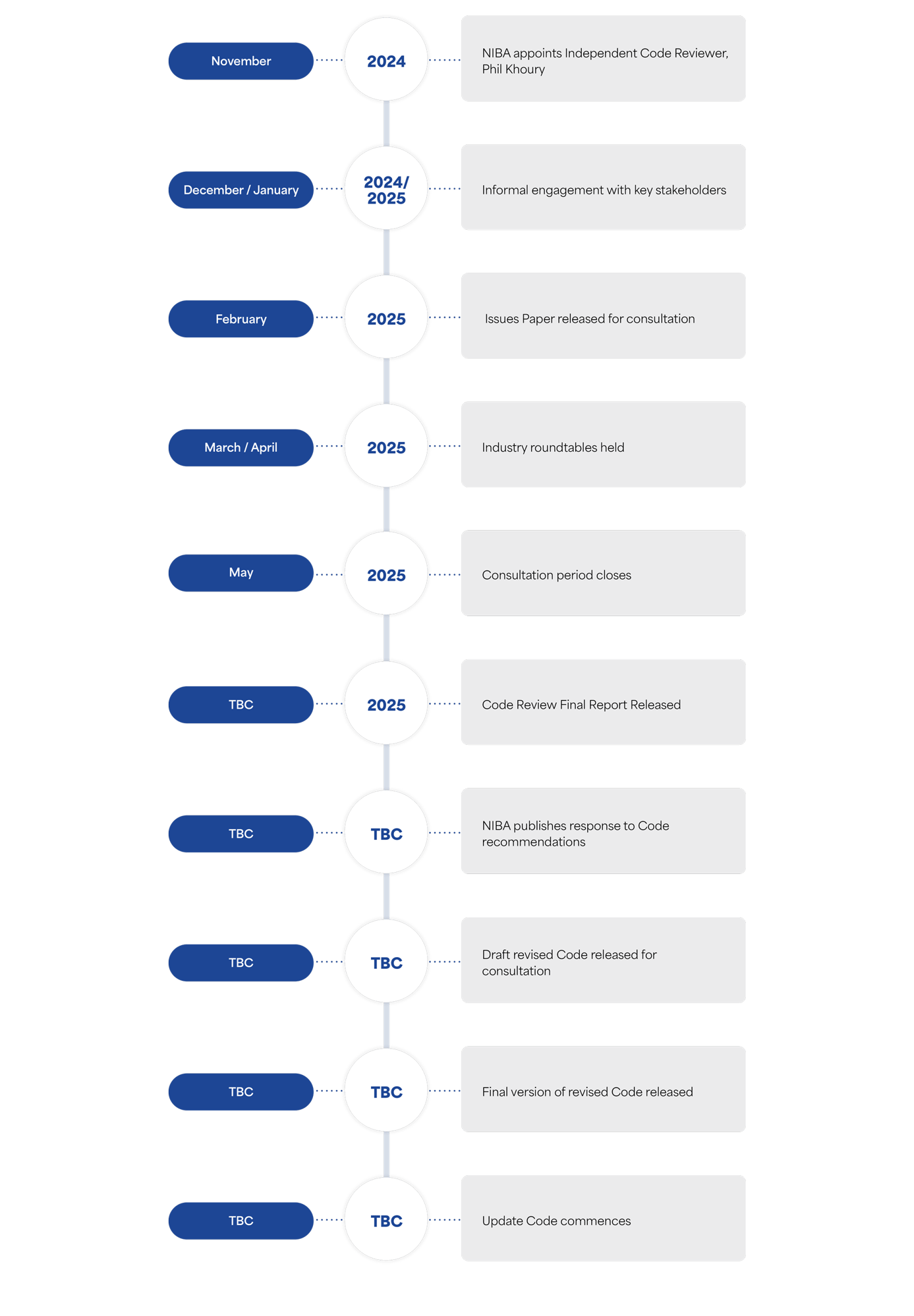

Code Review Timeline

December / January

Preliminary engagement with key stakeholders

February

March/April

Wide industry consultation and roundtables held

May/June

August

September - November

NIBA considers draft report and responds to Independent Reviewer

December

January

TBC

Draft revised Code released for consultation

TBC

Update Code commences

TBC

Final version of revised Code released

Stakeholder Consultation

Recognising that not all stakeholders have the resources, capacity or preference to prepare a written submission, the Code review process has adopted a multi‑channel and inclusive approach to consultation. This has ensured that a broad cross‑section of views could be heard and considered, regardless of organisational size or location.

Consultation to date has included direct engagement with key external stakeholders such as the Insurance Brokers Code Compliance Committee (IBCCC), ASIC, AFCA, the Australian Small Business and Family Enterprise Ombudsman (ASBFEO), the Financial Rights Legal Centre and NSW Fair Trading. In addition, Code Subscribers and insurers participated in a series of online roundtables, bringing together representatives from across the broking profession and the wider insurance sector to examine specific issues in greater depth.

So far, more than 40 individual organisations have contributed to the review through these various formal and informal channels. This multi‑layered approach has enabled rich, candid discussion and ensured that voices from across the general insurance landscape, including large national firms, regional brokers, industry bodies and consumer representatives, can meaningfully contribute to the conversation.

The breadth and depth of this engagement reflects the Reviews commitment to ensuring the revised Code is grounded in real‑world practice, responds to stakeholder expectations and remains practical and effective for brokers and clients alike.

Interested stakeholders should email their submission by 2 April, 5:00 PM AEDT to: code@niba.com.au